Is the Stock Market in a Bubble? — and How Can You Protect Yourself?

The stock market has an uncanny ability to surge higher even when uncertainty dominates the headlines. Investors love to ask: Is this growth real… or are we entering bubble territory?

Understanding what a stock market bubble is — and how to protect yourself before it bursts — is one of the most important financial skills any investor can learn. And with economic headlines still shifting rapidly, especially after the recent government shutdown drama (covered in last week’s article, Shutdown No More), it’s worth taking a closer look at where markets stand today.

What Exactly Is a Stock Market Bubble?

A stock market bubble occurs when asset prices rise far beyond their underlying economic value. It’s not just optimism — it’s irrational optimism driven by speculation, hype, and the fear of missing out.

The classic bubble pattern

Every bubble follows the same 5-stage pattern:

Displacement

Something new captures investor attention — a technology, policy shift, or trend.Boom

Prices rise rapidly as investors pile in.Euphoria

The belief that prices will never fall. This is where risk-taking peaks.Profit-taking

Savvy investors start quietly selling.Panic / Crash

Prices collapse as fear replaces euphoria.

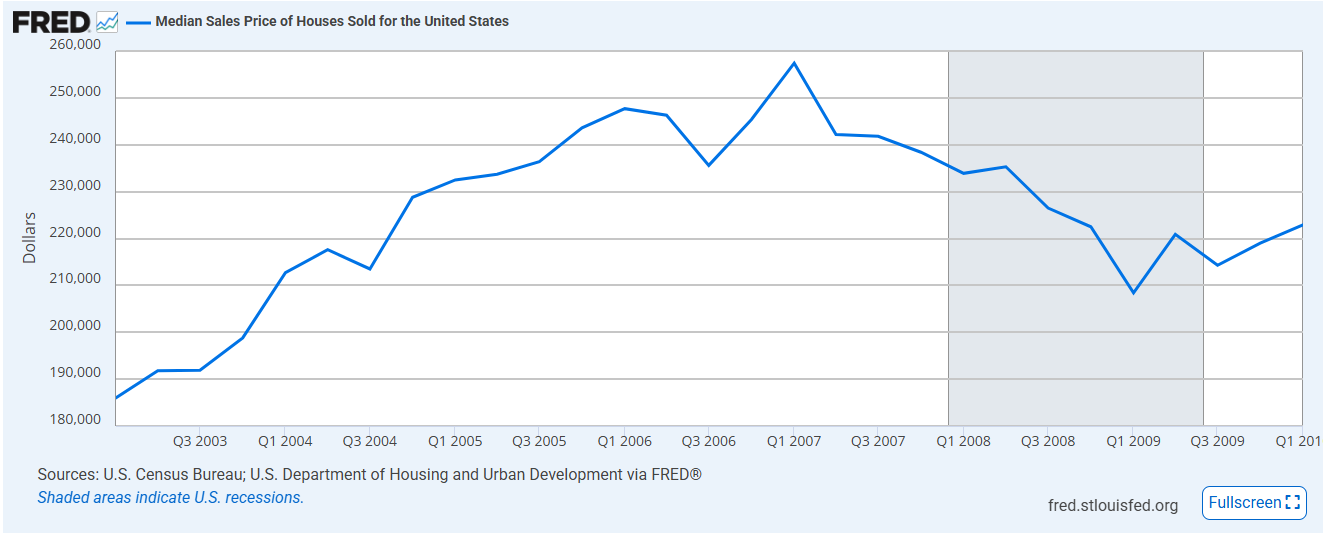

Graph depicting the bubble period and crash of the Housing Bubble of 2008.

If this sounds familiar, it should — from the Dot-Com Boom, Housing Bubble of 2008, and even parts of the Crypto Surge in 2021, history shows how quickly sentiment can flip.

Graph depicting the bubble period and crash of the Nasdaq Index during the Dot-Com Boom of the early 2000s.

Why Bubbles Happen: A Behavioral Perspective

Bubbles are rarely about fundamentals. They’re driven by human psychology:

✓ FOMO (Fear of Missing Out)

When everyone seems to be making money, nobody wants to be left behind.

✓ Herd Mentality

Investors copy one another — not because it’s smart, but because it feels safe.

✓ Easy Money Conditions

Low interest rates and abundant liquidity make risk-taking feel less risky.

✓ Narratives > Numbers

Stories become more compelling than valuations.

(”AI will change everything”… “This time is different”… sound familiar?)

These emotional drivers can inflate prices well beyond sustainable levels.

Are We in a Bubble Right Now?

Today’s market displays bubble-like pockets, but not necessarily a full-blown market-wide bubble.

Here are the strongest indicators analysts watch:

📌 High Valuations

Certain sectors — tech in particular — are trading at price-to-earnings multiples far above historical averages.

📌 Concentration Risk

A handful of mega-cap stocks have been responsible for most index gains, which makes the market more fragile.

📌 Retail Speculation Spikes

Search interest, social sentiment, and small-account trading activity often rise before corrections.

📌 Economic Headwinds

As we discussed in Shutdown No More, the government’s fiscal uncertainty and ongoing budget gridlock continue to create volatility beneath the surface.

📌 Mixed Signals From the Labor Market

Strong job growth and inflation trends help fundamentals… but long-term risks remain, including high federal debt, a slowing manufacturing sector, and tightening financial conditions.

Conclusion:

We’re not in universal bubble territory — but certain parts of the market are showing classic warning signs.

How to Protect Yourself From a Stock Market Bubble

The good news? You don’t need to predict exactly when a bubble will burst. You simply need to build a portfolio that can withstand one.

Here’s how:

1. Diversify Honestly — Not Just on Paper

Many investors believe they’re diversified because they own several stocks.

But if they’re all in tech? Or all in U.S. equities?

That’s not diversification — that’s concentration with extra steps.

True diversification includes:

Large-cap, mid-cap, and small-cap stocks

U.S. and international exposure

Bonds (short and intermediate-term)

Real assets or commodities

Potentially cash as dry powder

Diversification won’t guarantee gains — but it dramatically reduces catastrophic losses.

2. Avoid Momentum Chasing

If the only reason you’re buying something is because the price is going up… you’re already behind.

Ask yourself:

“Is the underlying company truly growing, or am I reacting to hype?”

Let fundamentals guide decisions — not fear.

3. Use Dollar-Cost Averaging (DCA)

Investing the same amount regularly helps you:

Reduce timing risk

Avoid emotional buy/sell decisions

Smooth out volatility over time

Most of the world’s best long-term investors swear by it.

4. Maintain a Cash Buffer

Cash is a strategic asset during bubbles.

It gives you:

A cushion if markets fall

The opportunity to buy good assets at a discount

Lower stress during periods of volatility

Even a small allocation helps.

5. Look at Valuations, Not Headlines

Good investors focus on:

Earnings growth

Balance sheet strength

Cash flow

Competitive advantages

Bubbles grow on stories; portfolios grow on mathematics.

6. Rebalance Periodically

If tech becomes too large a share of your portfolio, trim it.

If bonds become a much smaller portion, increase them.

Rebalancing forces you to:

Sell high

Buy low

Maintain risk discipline

It’s one of the simplest, most powerful tools investors have.

Final Thoughts

Stock market bubbles aren’t inherently bad — they often accompany innovation and economic growth. But they can be devastating if you’re not prepared.

By understanding the psychology behind bubbles, maintaining true diversification, and sticking to disciplined investing habits, you can reduce risk while still participating in long-term market growth.

And as we saw in Shutdown No More, markets can behave unpredictably even when Washington finally solves a crisis. Staying informed — and building a resilient financial plan — is the best buffer against whatever comes next.

If you enjoyed this article…

If you’re new here, you can subscribe to The Market Dispatch for free.

Every subscriber also gets instant access to our Retirement Calculator — a tool designed to help you estimate your long-term savings and visualize your path to financial independence.

👉 Subscribe free here:

(And get your free Retirement Calculator.)

Disclaimer:

The information provided by The Market Dispatch is for educational and informational purposes only and should not be construed as financial, legal, or investment advice.

The Market Dispatch, its authors, and contributors are not financial advisors, brokers, or attorneys. Any opinions, analyses, or projections expressed are solely those of the authors and do not constitute specific recommendations for any individual.

Investing involves risk, including the potential loss of principal and capital. Past performance does not guarantee future results. Before making any financial decisions or investments, you should consult with a qualified financial advisor or other professional who understands your personal circumstances.

By reading this newsletter or using any related materials, you acknowledge and agree that The Market Dispatch and its team will not be held liable for any loss, damage, or expense incurred as a result of reliance on the information provided.