The Week in Review: Markets Cap a Strong 2025 as Policy, Rates, and Global Events Shape 2026

Stocks finish 2025 with double-digit gains as mortgage rates hit yearly lows, the IRS rolls out new tax guidance, and Washington signals major shifts heading into the new year.

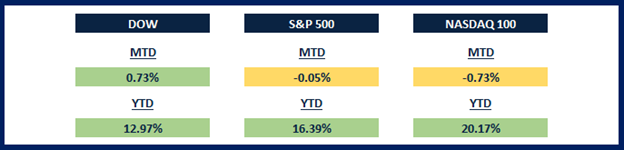

Following a wild October and the avalanche of news that we got during this past November, we saw December wrap up a very lucrative year for stocks. After leaving behind the government shutdown that kept us worried this Fall season, December was the positive conclusion to a year that saw all three major indices return gains of over 12%.

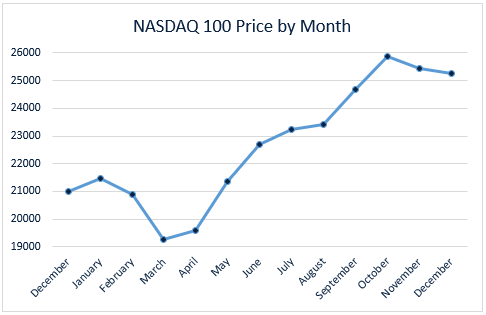

The king of all three indices was the tech-heavy Nasdaq 100 which, after battling concerns regarding an AI stock market bubble, finished the year up over 20%.

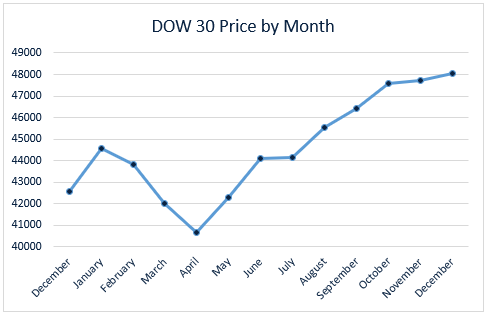

The Dow 30 finished the year at 48,063 points, up over 5,519 points from the beginning of the year and up 346 points from the start of December.

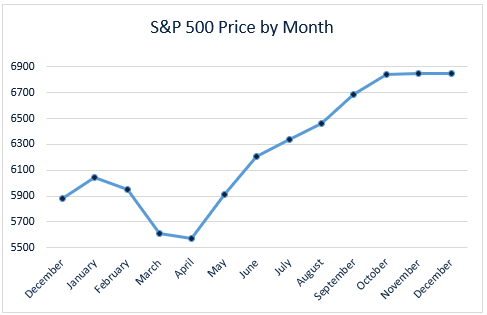

The S&P 500 closed out the year at 6,845 points, a gain of 963 points for the year and a slight loss of just 3 points for December.

The Nasdaq 100 closed out the year at 25,249 points, a gain of 4,237 points for the year and a loss of 185 points for December.

Nicolás Maduro arrested by U.S. Forces

On the morning of January 3rd, U.S. military forces arrested Venezuelan dictator Nicolás Maduro and his wife during a raid that took place in the military compound in the Venezuelan capital of Caracas where the Maduros were hiding. In the pre-dawn hours of January 3, a wave of U.S. military aircraft—both piloted and remotely operated—struck key Venezuelan air defense systems, clearing the way for an air assault by special operations forces. Helicopters inserted the team at a heavily secured compound where Nicolás Maduro and his wife were staying. Shortly after touching down, the troops moved rapidly through the site and apprehended the Venezuelan leader and his wife, Cilia Adela Flores de Maduro, before they were able to seal themselves inside a secure room and await assistance from loyal military units.

President Donald Trump shared a photo of captured Venezuelan President Nicolás Maduro aboard USS Iwo Jima after strikes on Venezuela, on Saturday, Jan. 3, 2026. (Donald Trump via Truth Social)

From the moment President Trump authorized the operation to the time the team departed Venezuelan airspace with both detainees, fewer than five hours passed. The operation was completed without any American casualties.

Maduro and his predecessor, Hugo Chavez, are responsible for turning what once was the most prosperous country in South America, into a totalitarian regime which has seen an estimated 8 million Venezuelans escape the country due to widespread poverty and political persecution.

U.S. officials including President Donald Trump and Secretary of State Marco Rubio have announced that the United States will be in charge of overseeing a transition process for Venezuela to become a democratic and prosperous country once again.

IRS issues guidance for No Tax on Tips and Overtime Deductions for 2026

The IRS has issued initial guidance explaining how the “no tax on tips” and “no tax on overtime” provisions of the One Big Beautiful Bill Act (OBBBA) will work for workers claiming deductions beginning with the 2025 tax year.

The legislation was signed into law by President Donald Trump in July after it cleared Congress with Republican support in a party-line vote. The measure combined tax changes with new spending provisions.

Among its key features are deductions for qualified tip income and eligible overtime pay. As directed by the statute, the Treasury Department and the IRS are now outlining how workers should calculate and claim those deductions.

According to the IRS, taxpayers who qualify may need to separately calculate their tipped and overtime income for 2025, since Forms W-2 and 1099 will not yet include dedicated fields for those amounts. The agency’s guidance includes examples showing how the deductions apply depending on whether the income was formally reported or not.

Under the OBBBA, employees who earn qualifying tips may deduct up to $25,000 per year, with the benefit gradually reduced for individuals earning more than $150,000 in modified adjusted gross income, or $300,000 for joint filers. The IRS estimates roughly six million workers report tip income, and this deduction applies to tax years from 2025 through 2028. Separately, the overtime provision allows workers to deduct the portion of overtime pay that exceeds their standard wage—generally the additional “half” in time-and-a-half compensation—when that income is reported on a W-2, 1099, or similar statement. That deduction is capped at $12,500 annually, or $25,000 for joint filers, and phases out above the same income thresholds. Importantly, the overtime deduction is available whether or not a taxpayer itemizes deductions.

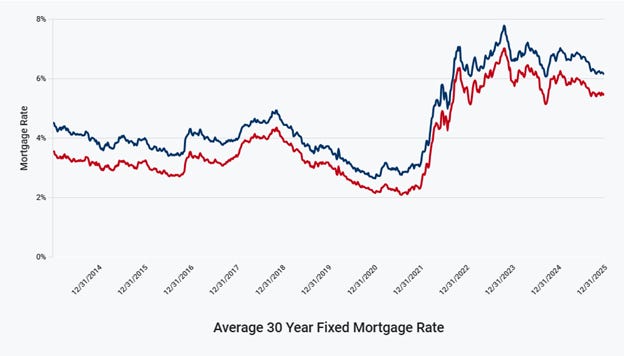

Mortgage rates hit 2025 lows to finish the year

Prospective homebuyers are heading into 2026 with a modest tailwind, as mortgage rates closed out the year at their lowest point of 2025. According to Freddie Mac’s latest Primary Mortgage Market Survey, the average rate on a standard 30-year fixed mortgage slipped to 6.15%, down slightly from 6.18% the previous week.

Rates began 2025 near the 7% mark, making the year-end decline notable.

Average 30 Year Fixed Mortgage Rate – courtesy of Fox Business

“After opening the year close to 7%, the 30-year fixed mortgage rate fell to its lowest level of 2025 in the final week of the year, which is a positive development for buyers as we enter the new year,” said Sam Khater, Freddie Mac’s chief economist. Lower financing costs could ease affordability pressures in the housing market, even as other indicators point to economic momentum under President Donald Trump.

Earlier this month, the Bureau of Economic Analysis published its first estimate of third-quarter gross domestic product, showing the economy expanded at a 4.3% annualized pace from July through September. That result exceeded the 3.3% growth forecast from economists surveyed by LSEG.

Looking ahead, would-be buyers are closely watching how aggressively the Federal Reserve may reduce interest rates in 2026. Minutes from the Fed’s December meeting revealed internal disagreement among policymakers, with two voting members favoring no rate cut and one pushing for a larger, 50-basis-point reduction. In addition, six officials’ economic projections indicated resistance to further easing.

Ultimately, the Fed approved a 25-basis-point cut for the third consecutive meeting in December, bringing the federal funds rate target range to 3.5%–3.75%. That move came amid signs of a cooling labor market while inflation remains above the central bank’s 2% goal, underscoring the tension between the Fed’s employment and price-stability objectives.

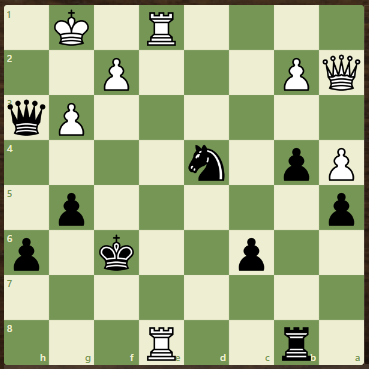

Finish it!

It’s black’s turn to play! Can you find the one move that ends the game with checkmate? Let us know what the move is on our Instagram page TheMarketDispatch , on X TheMRKTDispatch or on LinkedIn TheMarketDispatch

Disclaimer:

The information provided by The Market Dispatch is for educational and informational purposes only and should not be construed as financial, legal, or investment advice.

The Market Dispatch, its authors, and contributors are not financial advisors, brokers, or attorneys. Any opinions, analyses, or projections expressed are solely those of the authors and do not constitute specific recommendations for any individual.

Investing involves risk, including the potential loss of principal and capital. Past performance does not guarantee future results. Before making any financial decisions or investments, you should consult with a qualified financial advisor or other professional who understands your personal circumstances.

By reading this newsletter or using any related materials, you acknowledge and agree that The Market Dispatch and its team will not be held liable for any loss, damage, or expense incurred as a result of reliance on the information provided.