Wrapping up a wild October!

Stocks reached new all time highs again this month

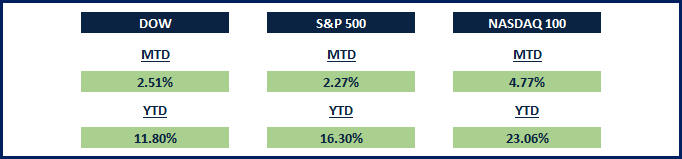

The Dow Jones Industrial Average, S&P 500 and Nasdaq 100 indices continued their advance this month, with the three indices up Year-To-Date 11.8%, 16.3% and 23.06% respectively.

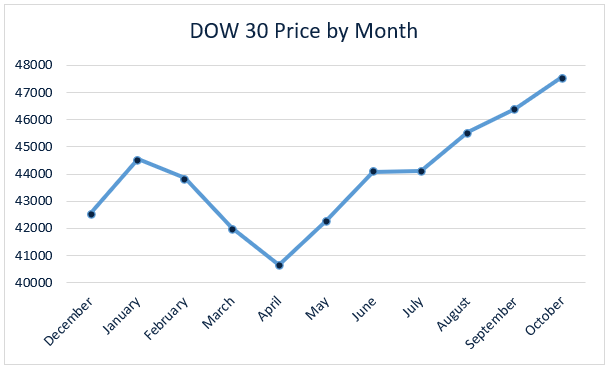

The Dow 30 finished the month at 47,562, up over 5,000 points from the beginning of the year.

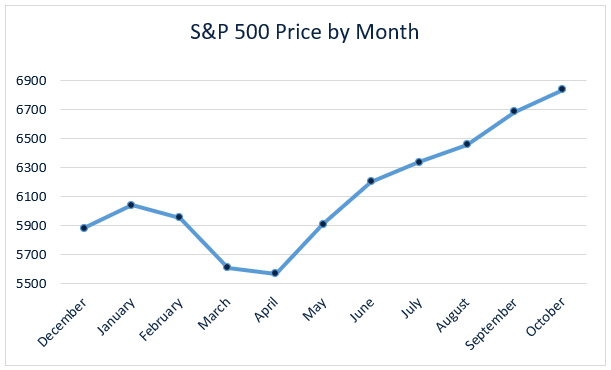

The S&P 500 closed out the month at 6,840 points, a gain of 958 points for the year.

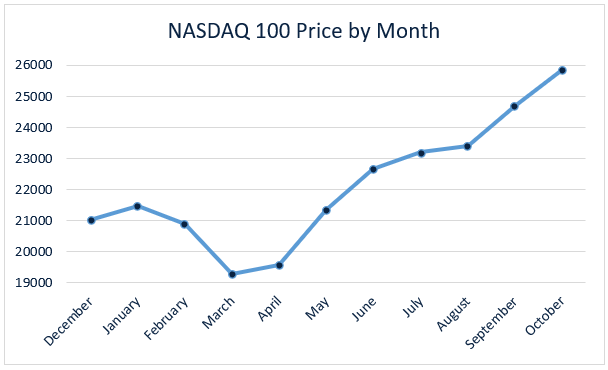

The tech-heavy Nasdaq 100 index continues its bull run, reaching 25,858 points to finish October up by 4,845 points for 2025.

Inflation reading for September lower than anticipated by economists

The Consumer Price Index – the main indicator that economists look at to assess the rate of inflation for our economy – came in at 3% year over year during this month’s reading. This marks a downward trend when comparing it to the inflations highs we experienced during 2022, when inflation reached a yearly rate of 10%.

The CPI report had been initially delayed from its October 15 scheduled release date due to the current government shutdown. However, this month’s report was deemed critical and had to be released (even if it was past it’s originally scheduled date) since it is used by the Social Security Administration to calculate the 2026 cost-of-living adjustment (a measure that affects about 75 million people).

Traders will be paying close attention to the progress being made on inflation since a lower number will continue putting pressure on the Federal Reserve to slash interest rates.

Powell pours cold water on investors’ hopes

This Wednesday the Federal Reserve announced a quarter point rate cut during their press conference. While the market had fully priced in this rate cut, investors were surprised to hear Federal Reserve Chairman Jerome Powell tell reporters not to take a December rate cut for granted.

“In the committee’s discussions at this meeting, there were strongly differing views about how to proceed in December,” declared Jerome Powell. “A further reduction in the policy rate at the December meeting is not a foregone conclusion. Far from it.”

The comments from the Chairman rattled the markets, leaving investors wondering if the highly anticipated cuts in interest rates will actually happen before Powell’s term expires in May of next year.

Trump and Xi meet again

During a highly anticipated trade meeting in South Korea Thursday, President Trump and President Xi reached an agreement to lower tariffs imposed on China while pausing export controls on rare earth minerals that China had imposed on the United States.

The American President announced he will visit China in April, and President Xi will also travel to the United States to continue trade discussions as well.

President Trump also announced that he lowered punitive tariffs imposed on China due to its role in trafficking fentanyl from 20% down to 10%. This brings the effective tariff rate on China to around 47% according to President Trump.

Russia on guard!

According to a post published by President Trump on his Truth Social platform, the American President has instructed the “Department of War” (as he referred to the Department of Defense on his post) to resume nuclear testing.

Across the ocean, the Kremlin reacted on Thursday by warning that Russia would “act accordingly” if the United States was to break the moratorium on nuclear weapons testing agreed on during the Cold War.

The announcement by the White House comes after Russia tested their Burevestnik long-range cruise missile, which features the ability to be equipped with nuclear warheads.

Can you checkmate the King?

It’s black’s turn to play! Can you find the one move that ends the game with checkmate? Let us know what the correct move is on our Instagram page The Market Dispatch or our X page TheMrktDispatch

Questions? Email us: editor@themarketdispatch.com

Disclaimer:

The information provided by The Market Dispatch is for educational and informational purposes only and should not be construed as financial, legal, or investment advice.

The Market Dispatch, its authors, and contributors are not financial advisors, brokers, or attorneys. Any opinions, analyses, or projections expressed are solely those of the authors and do not constitute specific recommendations for any individual.

Investing involves risk, including the potential loss of principal and capital. Past performance does not guarantee future results. Before making any financial decisions or investments, you should consult with a qualified financial advisor or other professional who understands your personal circumstances.

By reading this newsletter or using any related materials, you acknowledge and agree that The Market Dispatch and its team will not be held liable for any loss, damage, or expense incurred as a result of reliance on the information provided.