Markets Enter 2026 Amid Fed Turmoil, Iran Tensions, and a Credit Card Rate Shock

Jerome Powell faces a federal investigation, Trump caps credit card rates, Iran signals openness to talks, and U.S. health policy gets a major reset

After a great finish to 2025 where we popped champagne and not market bubbles, 2026 is turning out to be a year full of economic and global news! With the government fully operational after the shutdown we lived through in the Fall, this week brings us a lot of big developments. Here are some of the most important ones:

Jerome Powell under Federal investigation!

This week, Federal Reserve Chairman Jerome Powell announced that is under criminal investigation by the Justice Department. The investigation focuses on his testimony to Congress, where he appeared to explain the Federal Reserve’s ongoing $2.5 billion renovations of the central bank’s headquarters, and whether he committed perjury during his testimony to lawmakers.

US Federal Reserve Board Chairman Jerome Powell speaks during a news conference following a Federal Open Market Committee (FOMC) meeting in Washington, DC, on Dec. 10, 2025. - Saul Loeb | AFP | Getty Images

Powell is defending himself by claiming that this investigation is politically motivated: “The threat of criminal charges is a consequence of the Federal Reserve setting interest rates based on our best assessment of what will serve the public, rather than following the preferences of the President,” Powell said in a video statement published on the Federal Reserve’s X account.

CNBC reports that a DOJ spokesperson said, in a statement to the news outlet: “The Attorney General has instructed her US Attorneys to prioritize investigating any abuse of taxpayer dollars.”

Iran ‘prepared’ for war but open to negotiating with the United States

After two weeks of violent unrest, Iran’s Foreign Minister claims their security forces have “full control” of the country. His comments come amid reports claiming that the Iranian government has reached out to President Trump after he declared that the US would be open to intervene in the conflict if protestors were killed.

On Sunday, President Trump spoke to reporters about the situation in Iran and the role that the United States could play: “They’re starting to, it looks like, and there seem to be some people killed that aren’t supposed to be killed,” the president said. “These are violent — if you call them leaders, I don’t know if they’re leaders or just if they rule through violence. And, we’re looking at some very strong options. We’ll make a determination.”

President Donald Trump spoke with reporters aboard Air Force One while traveling from his Mar-a-Lago estate in Palm Beach, Fla., to Joint Base Andrews on Sunday, Jan. 11, 2026. (Alex Brandon/AP)

The U.S. based Human Rights Activists News Agency reported that more than 10,600 people have been detained during the more than two weeks of protests, with hundreds of protestors killed during the demonstrations.

President Trump announces a new 10% limit on credit card rates

This past week, President Trump announced a one-year cap that would limit interest to 10% on credit cards. The announcement comes amid a renewed push for affordability by the Trump Administration to try to provide some much needed relief to households affected by the current high prices and high interest rates environment.

“Please be informed that we will no longer let the American Public be ‘ripped off’ by Credit Card Companies that are charging Interest Rates of 20 to 30%, and even more, which festered unimpeded during the Sleepy Joe Biden Administration,” Trump wrote in a Truth Social post.

Banks and financial representatives have criticized this move, claiming that lower rates will stop banks from extending credit to borrowers with lower credit scores. Some people also argue that credit card companies won’t be able to offer users as many rewards through their points programs if rates are capped at 10%, since most credit card companies finance rewards through their fees.

Turning the Food Pyramid upside down!

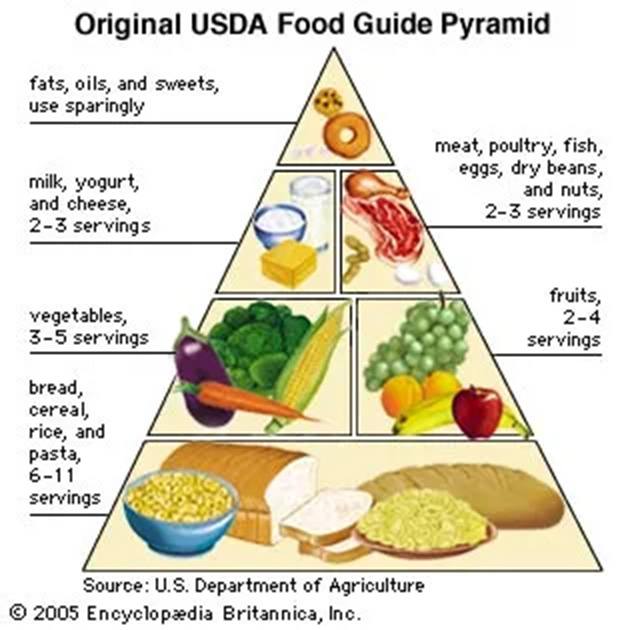

This past week, Health Secretary Robert F. Kenndy released an updated version of the Food Pyramid, along with new dietary guidelines which represent a dramatic change from previous versions.

Previous versions of the Food Pyramid emphasized high consumption of bread, carbohydrates and simple sugars while discouraging animal fat and protein. The new and updated version turns this on its head.

Former version of the Food Pyramid that emphasized high carbohydrate and simple sugar consumption.

New version of the Food Pyramid, emphasizing fruits, vegetables and protein.

The new version of the Food Pyramid places emphasis on consuming non-processed, natural foods like meat, dairy and vegetables. Because these foods are non-processed, they are digested easily by our body. They also have very high nutritional value, so they provide us with much higher doses of all the vitamins and nutrients that our body needs.

The former Food Pyramid influenced food policy decisions for decades and is, in part, responsible for creating a society where more than 2 in 5 adults (42.4%) have obesity.

Finish it!

It’s white’s turn to play! Can you find the one move that ends the game with checkmate? Let us know what the move is on our Instagram page TheMarketDispatch , on X TheMRKTDispatch or on LinkedIn TheMarketDispatch

Disclaimer:

The information provided by The Market Dispatch is for educational and informational purposes only and should not be construed as financial, legal, or investment advice.

The Market Dispatch, its authors, and contributors are not financial advisors, brokers, or attorneys. Any opinions, analyses, or projections expressed are solely those of the authors and do not constitute specific recommendations for any individual.

Investing involves risk, including the potential loss of principal and capital. Past performance does not guarantee future results. Before making any financial decisions or investments, you should consult with a qualified financial advisor or other professional who understands your personal circumstances.

By reading this newsletter or using any related materials, you acknowledge and agree that The Market Dispatch and its team will not be held liable for any loss, damage, or expense incurred as a result of reliance on the information provided.