November 2025 Market Update: Stocks Rise, Thanksgiving Costs Fall, and Peace Talks Move Forward

November 2025 saw stocks climb, Thanksgiving dinner costs fall, and consumers grow cautious. Here’s the full market update and key economic trends shaping 2026.

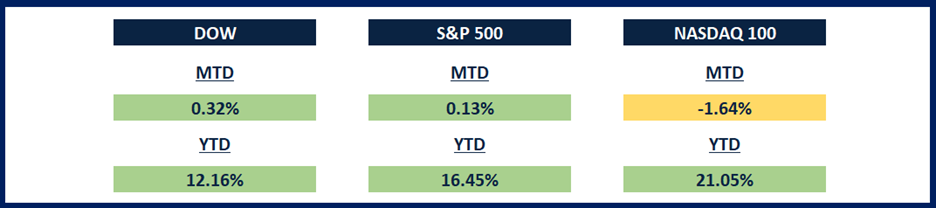

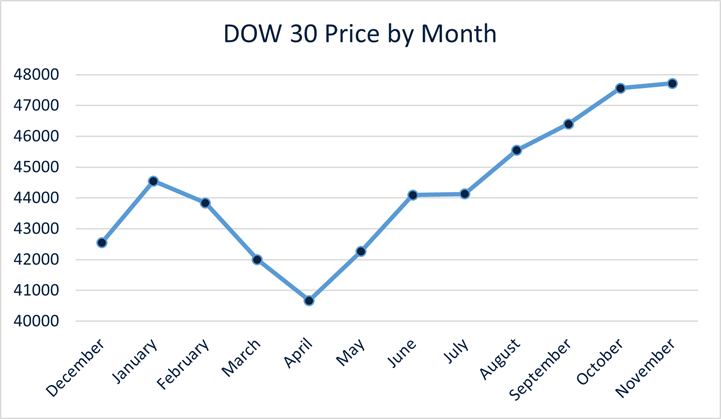

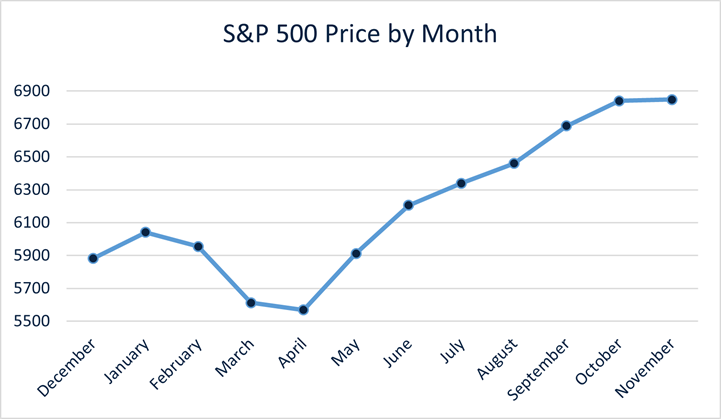

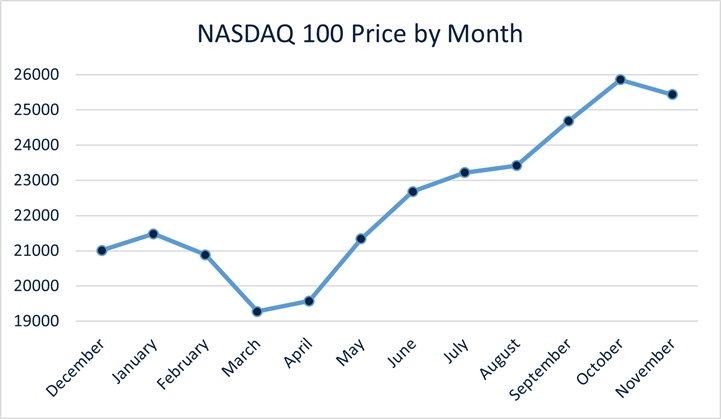

November was expected to be a tame month after a wild October, but it actually brought us an avalanche of stock market news this month. With the government shutdown finally over, The Dow Jones Industrial Average and S&P 500 turned positive in November after a tumultuous month marked by a brief panic regarding AI stocks. The Nasdaq 100 finished the month in the red after investors tried to figure out if tech stocks are in bubble territory or fairly priced. The Dow 30, S&P 500 and Nasdaq 100 are still enjoying very healthy gains for the year with the indices up 12.16%, 16.45% and 21.05% respectively.

The Dow 30 finished the month at 47,716, up over 5,172 points from the beginning of the year and up 153 points from the start of November.

The S&P 500 closed out the month at 6,849 points, a gain of 967 points for the year and just up 9 points for November.

The Nasdaq 100 closed out the month at 25,435 points, a gain of 4,422 points for the year and a loss of 423 points for November.

Cheaper Prices for Thanksgiving Dinner!

According to the American Farm Bureau Federation, the cost of your traditional Thanksgiving dinner for 10 people is down from a year ago. This traditional meal includes sides like stuffing, rolls, sweet potatoes, peas, cranberries, a 16 pound turkey and items for dessert such as pumpkin pie – and it costs about $55.18 nationwide in 2025.

This traditional meal reached an all time-high in 2022, when it took $64.05 to purchase it. This year, its price is down about 5% from its 2024 price level.

According to the American Farm Bureau Federation, this is the average price for the same meal for the last 10 years:

· 2015: $50.11

· 2016: $49.87

· 2017: $49.12

· 2018: $48.90

· 2019: $48.91

· 2020: $46.90

· 2021: $53.31

· 2022: $64.05

· 2023: $61.17

· 2024: $58.08

· 2025: $55.18

Peace in Ukraine before Christmas?

This past week, several news outlets have reported that Ukraine is willing to move forward with a framework for a peace deal backed by the United States. This deal would end the yearslong war between Russia and the Ukraine that started in 2022 when Russia launched their military offensive against their European neighbor.

President Trump stated at the White House this past week that the U.S. is “getting very close to a deal”. He also posted on social media that there are just “a few remaining points of disagreement” between the different countries involved in this negotiation process. The U.S. President also announced that he would be meeting with Russian President Vladimir Putin and Ukrainian President Volodymyr Zelenskyy “when the deal to end this War is FINAL or, in its final stages.”

A Russian official told reporters earlier this week that Russia hasn’t received any official documents with a draft of the peace deal. Steve Witkoff (U.S. Special Envoy) is scheduled to travel to Russia this week to meet with Putin.

Consumer Confidence Hits Lowest Point Since April

The Conference Board’s November report revealed a sharp decline in consumer confidence. The survey found that consumers are feeling specially pessimistic about the current economy and their ability to find a job.

“Consumers were notably more pessimistic about business conditions six months from now,” stated Dana Peterson, who currently serves as The Conference Board’s Chief Economist. “Mid-2026 expectations for labor market conditions remained decidedly negative, and expectations for increased household incomes shrunk dramatically, after six months of strongly positive readings.”

Consumers also stated that they expect inflation to continue pushing prices higher, leaving them with less money to spend on discretionary items.

Finish it!

It’s white’s turn to play! Can you find the one move that ends the game with checkmate? Let us know what the move is on our Instagram page TheMarketDispatch , on X TheMRKTDispatch or on LinkedIn TheMarketDispatch

Disclaimer:

The information provided by The Market Dispatch is for educational and informational purposes only and should not be construed as financial, legal, or investment advice.

The Market Dispatch, its authors, and contributors are not financial advisors, brokers, or attorneys. Any opinions, analyses, or projections expressed are solely those of the authors and do not constitute specific recommendations for any individual.

Investing involves risk, including the potential loss of principal and capital. Past performance does not guarantee future results. Before making any financial decisions or investments, you should consult with a qualified financial advisor or other professional who understands your personal circumstances.

By reading this newsletter or using any related materials, you acknowledge and agree that The Market Dispatch and its team will not be held liable for any loss, damage, or expense incurred as a result of reliance on the information provided.