Greenland Tariffs, 6% Mortgage Rates, and the Cuban Deal Ultimatum

Trump pressures the EU over Greenland, mortgage rates hit a 3-year low, and the Venezuela-Cuba lifeline is officially cut. Here is your 2026 breakdown.

January continues with plenty of global economic news! From possible stock market bubbles to mortgage rates and global events, 2026 is off to a busy start!

White House announces new EU tariffs over Greenland

President Trump announced a new round of escalating tariffs on eight NATO allies this Saturday, aiming to pressure them into a “Complete and Total purchase of Greenland“. Starting February 1, goods from nations including Denmark, Germany, and the U.K. will face a 10% tariff, which is scheduled to spike to 25% by June.

President Trump signing documents in the Oval Office (Courtesy of The White House)

The President justified the move by claiming these nations have moved troops into the territory for “purposes unknown,” calling it a danger to global security. The administration appears to be utilizing broad executive powers to bypass existing trade deals, framing the acquisition of the Danish territory as a vital national security priority.

European leaders have blasted the move as “hostile,” with Swedish Prime Minister Ulf Kristersson stating, “We will not allow ourselves to be blackmailed”. While the EU convenes an emergency meeting to coordinate a response, the U.S. Supreme Court could rule as early as next week on whether the President has the legal authority to impose these types of “emergency” penalties.

Mortgage rates hit 3-year low as White House targets high housing costs

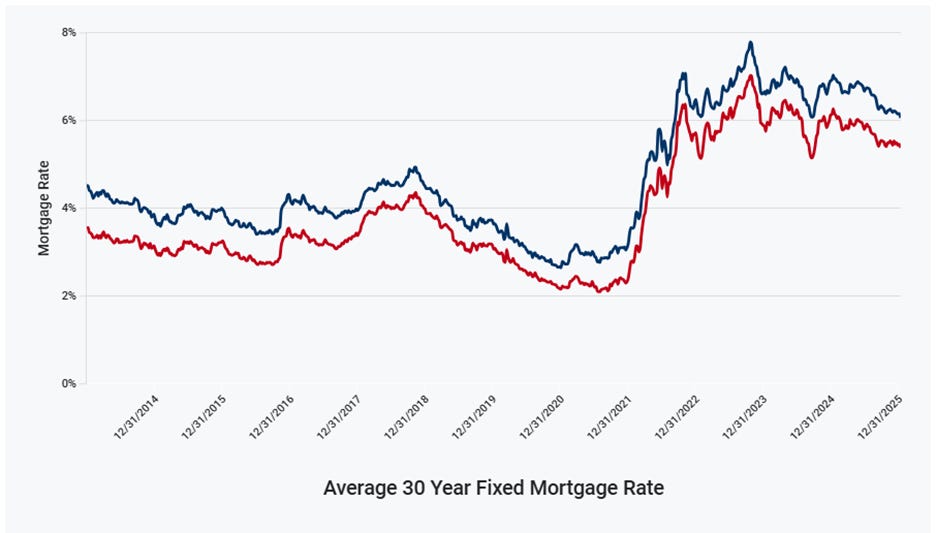

Mortgage rates have dropped to their lowest level in over three years, with the average 30-year fixed rate falling to 6.06%. Freddie Mac’s chief economist, Sam Khater, noted a significant jump in both home purchase applications and refinancing activity, signaling a strong start to the 2026 housing season.

Average 30 year Fixed Mortgage Rate (courtesy of Fox Business)

The decline follows a major move by President Trump, who recently ordered the government to purchase $200 billion in bonds to help drive down borrowing costs. FHFA Director William Pulte confirmed that an initial $3 billion round of purchases has already begun as the administration looks to ease the financial burden on families.

To further boost affordability, the President also proposed banning large institutional investors from buying single-family homes, arguing that hard-working Americans are being priced out of the market. While analysts at Realtor.com expect rates to stay in the low-6% range, they caution that the recovery will likely be a “gradual” process rather than an overnight boom.

President Trump issues ultimatum to Cuba: “Make a deal!”

President Trump signaled a massive shift in Caribbean policy last week, vowing to halt all oil and financial support to Cuba. Posting on Truth Social, the President stated, “THERE WILL BE NO MORE OIL OR MONEY GOING TO CUBA - ZERO!” He urged the island nation to negotiate with the U.S. immediately before it is “too late.”

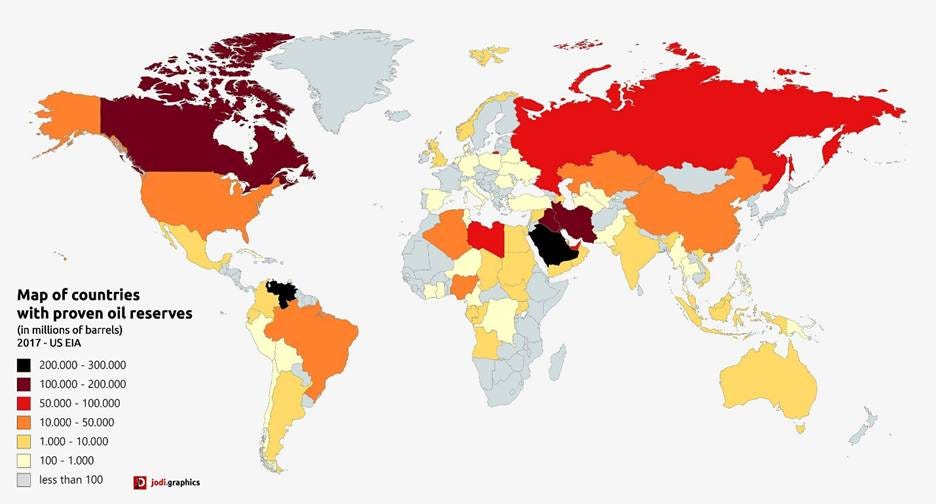

A few countries dominate world oil production (courtesy of Wikipedia maps)

This hardline stance follows the recent capture of Venezuelan leader Nicolas Maduro by U.S. forces. For decades, Venezuela served as Cuba’s primary energy lifeline, providing thousands of barrels of subsidized oil daily. With Maduro in custody and the U.S. now blockading Venezuelan exports, Cuba is facing severe power shortages and a crumbling economy.

To solidify this new energy landscape, Trump met with major oil executives as well to discuss returning American companies to Venezuelan oil fields. The President pledged to put U.S. refiners at the forefront of production, aiming to drive down energy prices while stripping Havana of its last major regional ally.

Finish it!

It’s black’s turn to play! Can you find the one move that ends the game with checkmate? Let us know what the move is on our Instagram page TheMarketDispatch , on X TheMRKTDispatch or on LinkedIn TheMarketDispatch

Disclaimer:

The information provided by The Market Dispatch is for educational and informational purposes only and should not be construed as financial, legal, or investment advice.

The Market Dispatch, its authors, and contributors are not financial advisors, brokers, or attorneys. Any opinions, analyses, or projections expressed are solely those of the authors and do not constitute specific recommendations for any individual.

Investing involves risk, including the potential loss of principal and capital. Past performance does not guarantee future results. Before making any financial decisions or investments, you should consult with a qualified financial advisor or other professional who understands your personal circumstances.

By reading this newsletter or using any related materials, you acknowledge and agree that The Market Dispatch and its team will not be held liable for any loss, damage, or expense incurred as a result of reliance on the information provided.